Dion Nissenbaum and Rory Jones

WSJ, May 8, 2022

“If we can get Israelis and Muslims in the region to do business together it will focus people on shared interests and shared values. We kicked off historic regional change which needs to be reinforced and nurtured to achieve its potential.”

Jared Kushner’s new private-equity fund plans to invest millions of dollars of Saudi Arabia’s money in Israeli startups, according to people familiar with the investment plan, in a sign of warming ties between two historic rivals.

Affinity Partners, which has raised more than $3 billion, including a $2 billion commitment from the kingdom’s sovereign-wealth fund, has already selected the first two Israeli firms to invest in, these people said.

The decision marks the first known instance that the Saudi Public Investment Fund’s cash will be directed to Israel, a sign of the kingdom’s increasing willingness to do business with the country, even though they have no diplomatic relations. This could help lay the groundwork for a breakthrough normalization pact between the two countries.

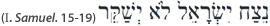

Israel is deepening business and security ties with Arab states, including the United Arab Emirates, nearly two years after the U.S. brokered historic normalization deals. Mr. Kushner, former President Donald Trump’s son-in-law and a former senior White House adviser, played an instrumental role in the so-called Abraham Accords.

To view the original article, click here