Gideon Lewis-Kraus

New Yorker, Dec. 1, 2022

“If you’re personally affected by what’s happening, the community health team wants to be here for you. We’ve already heard from people who are feeling worried, angry, or sad.”

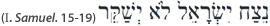

One of the inevitable questions to have attended the abrupt undoing of the erstwhile billionaire Sam Bankman-Fried—the overnight collapse of his cryptocurrency exchange, FTX, and its intertwined sister organization, the trading firm Alameda Research—concerns that of the part in the fiasco played by ideas. Neither Bernie Madoff, Kenneth Lay, nor Jeff Skilling was, to the best of my knowledge, associated with a particular philosophical tradition. Bankman-Fried has, however, identified himself as an adept of effective altruism, the utilitarian-flavored philanthropic social movement. Bankman-Fried first encountered effective altruism, or E.A., as an M.I.T. undergraduate, when he was introduced to the Oxford philosopher Will MacAskill. E.A. leaders recruited Bankman-Fried as someone likely to make a lot of money that he might then give away for the betterment of the world. In less than a decade, the investment seemed to have proved auspicious: Bankman-Fried became the movement’s most prominent donor, promising to eventually donate almost all of his net worth, which was once estimated at twenty-six billion dollars. He has said, on multiple occasions, that his consideration for the lives of others aroused his appetite for financial risk: had he been working merely for his own pleasure, he might have comfortably retired a minor billionaire, but there is no diminishing marginal utility to each additional dollar earned to redeem the world.

He flipped the coin—or, rather, a lot of coins, many of which he had himself invented—until he lost. Unfortunately, it seems he was playing with someone else’s money: FTX’s customer deposits were commingled with Alameda’s own funds, where they were apparently used to shore up bad trades and ill-advised investments. The whole operation lost something like eight billion to ten billion dollars, if not more. (Bankman-Fried has said that poor labelling of accounts was to blame. His spokesperson told me that the meltdown was the result of a “large market crash,” and said, “Mr. Bankman-Fried never knowingly used FTX deposits to shore up any trades or investments.”) Critics of E.A. have delighted in Schadenfreude, as if the mask of optimized benevolence has slipped to reveal the naked will to power. When Bankman-Fried participated in a direct-message interview with Vox’s Kelsey Piper, earlier this month, his casually dismissive comments about “ethics” were immediately taken as confirmation that E.A. was a sham—a convenient alibi for greed and the lust to dominate. For those of us who are secretly unsure whether we’re decent people, this came as a reassuring development. The elementary tenet of effective altruism—that privileged Westerners could be doing considerably more good in the world than most of us do—could be discarded as self-serving cant. (The spokesperson said, “Mr. Bankman-Fried does in fact deeply believe in Effective Altruism, and always has, but he thinks that there are many things that companies do—specifically highly regulated ones—around the edges to attempt to appear as ‘good actors.’ ”) Source